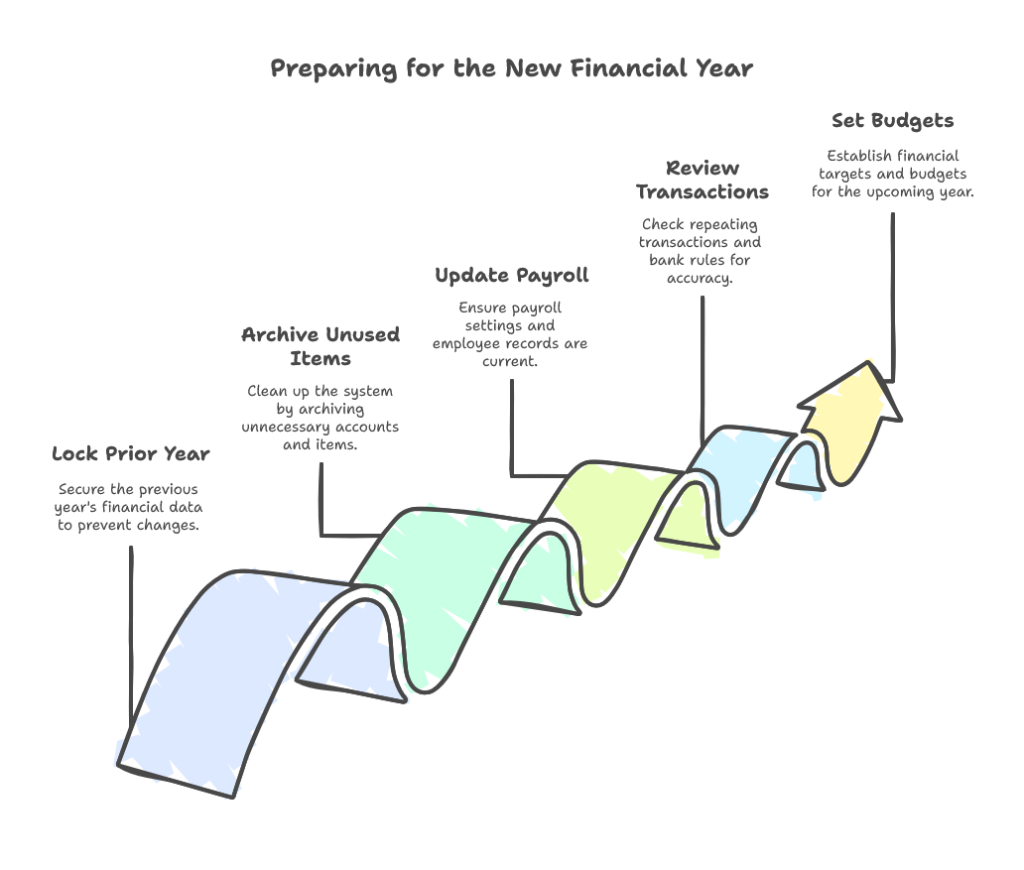

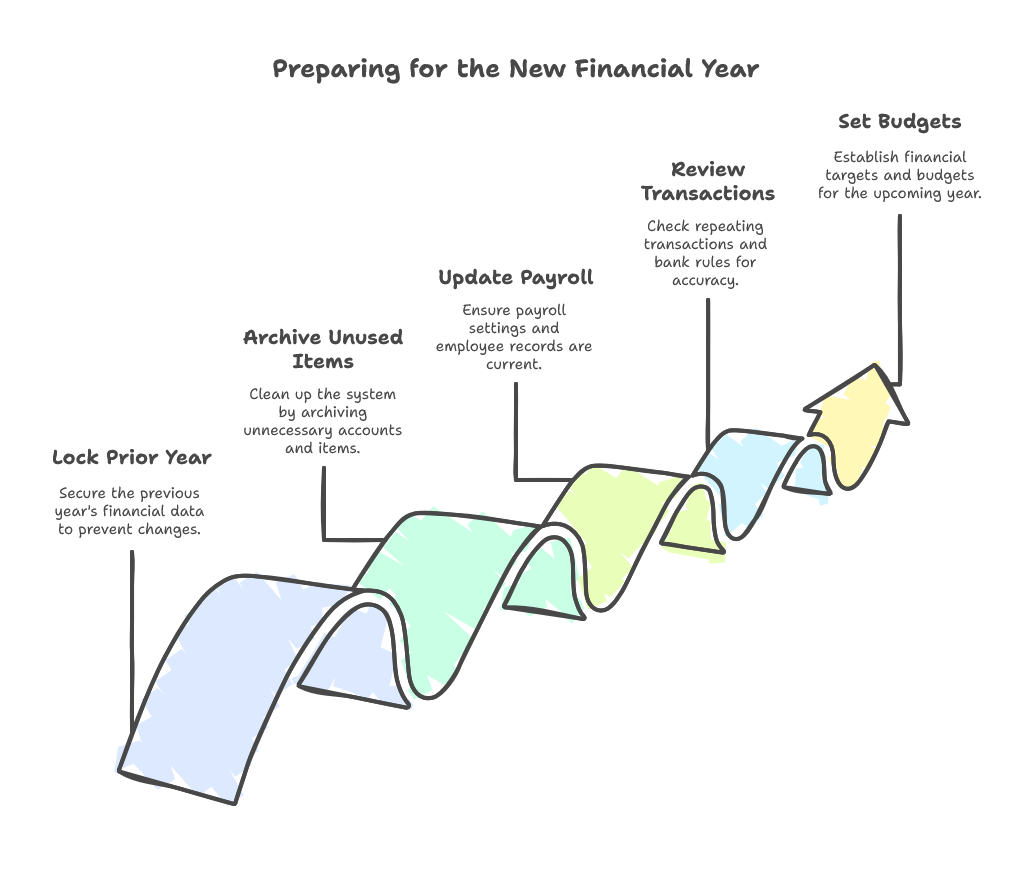

You’ve finalised another financial year – congratulations! Before you switch back to business as usual, this is the perfect opportunity to tidy, tune, and plan your Xero file to avoid bottlenecks down the track.

Here are five practical post-EOFY Xero tasks to give your business a clean slate for the 2025–26 year.

1. Lock the Prior Financial Year

Once your accountant or BAS agent has signed off, lock your 2024–25 data to prevent accidental edits. This preserves the integrity of your lodged BAS and tax reports.

In Xero:

Navigate to Settings → Advanced → Financial Settings and set a lock date. You can apply a separate user lock for staff while maintaining full access for your advisor.

2. Archive Unused Accounts, Tracking Categories, and Pay Items

EOFY is the ideal time to tidy up your file. Archiving or merging unused chart of accounts, outdated tracking categories, and redundant pay items keeps your reports clean and manageable.

Suggested clean-up actions:

- Archive tracking categories from completed projects or expired grants

- Merge duplicate expense or income accounts

- Remove legacy pay items (ensure STP mapping is accurate before doing so)

3. Update Payroll Settings and Employee Records

From July 1, updated wage rates, super thresholds, and STP requirements take effect. Make sure your records are current.

Checklist:

- Review and adjust employee classifications and pay rates

- Verify leave balances and accrual settings

- Confirm TFNs, tax categories, and super fund details for new staff

Also, audit closely held payees if you report them quarterly.

4. Review Repeating Transactions and Bank Rules

Automation is useful—but only if it’s still accurate. Take this opportunity to:

- Review repeating invoices and bills for relevance and correctness

- Ensure bank rules apply correct accounts and GST treatments

- Disable any automation linked to inactive suppliers or customers

This reduces the risk of misclassifications in upcoming BAS periods.

5. Set Budgets and Cash Flow Goals for the Year Ahead

Without a plan, it’s easy to repeat last year’s mistakes. Even a simple monthly budget can help you:

- Monitor financial performance

- Improve cash flow visibility

- Prepare for tax, super, or other major obligations

In Xero:

Use Budget Manager or connect tools like Fathom, Syft, or Float to enhance your forecasting.

Take Control of the New Financial Year

EOFY clean-up is a major achievement—but now is your chance to implement smarter systems for the year ahead.

If your Xero file feels bloated or you’re unsure where to start, I offer:

- Post-EOFY Xero Health Checks

- New Year Setup & Report Customisation

- Payroll and STP Compliance Reviews

Let’s get your Xero file streamlined and ready for growth.

Book a free 15-minute discovery call → Here

Make 2025–26 simpler, smoother, and more profitable.